The following article was written by Jennifer Eilert with CISA Insurance. While Ms. Eilert is not an employee of Costello Sury & Rooney, her article is both relevant and informative for community associations, and we are thereby republishing it with her Ms. Eilert’s consent.

We are in unprecedented insurance times! There are several factors working against a stable insurance market in which premium increases continue to soar. If you want to understand these reasons better, please reach out to your CISA Account Executive for more details.

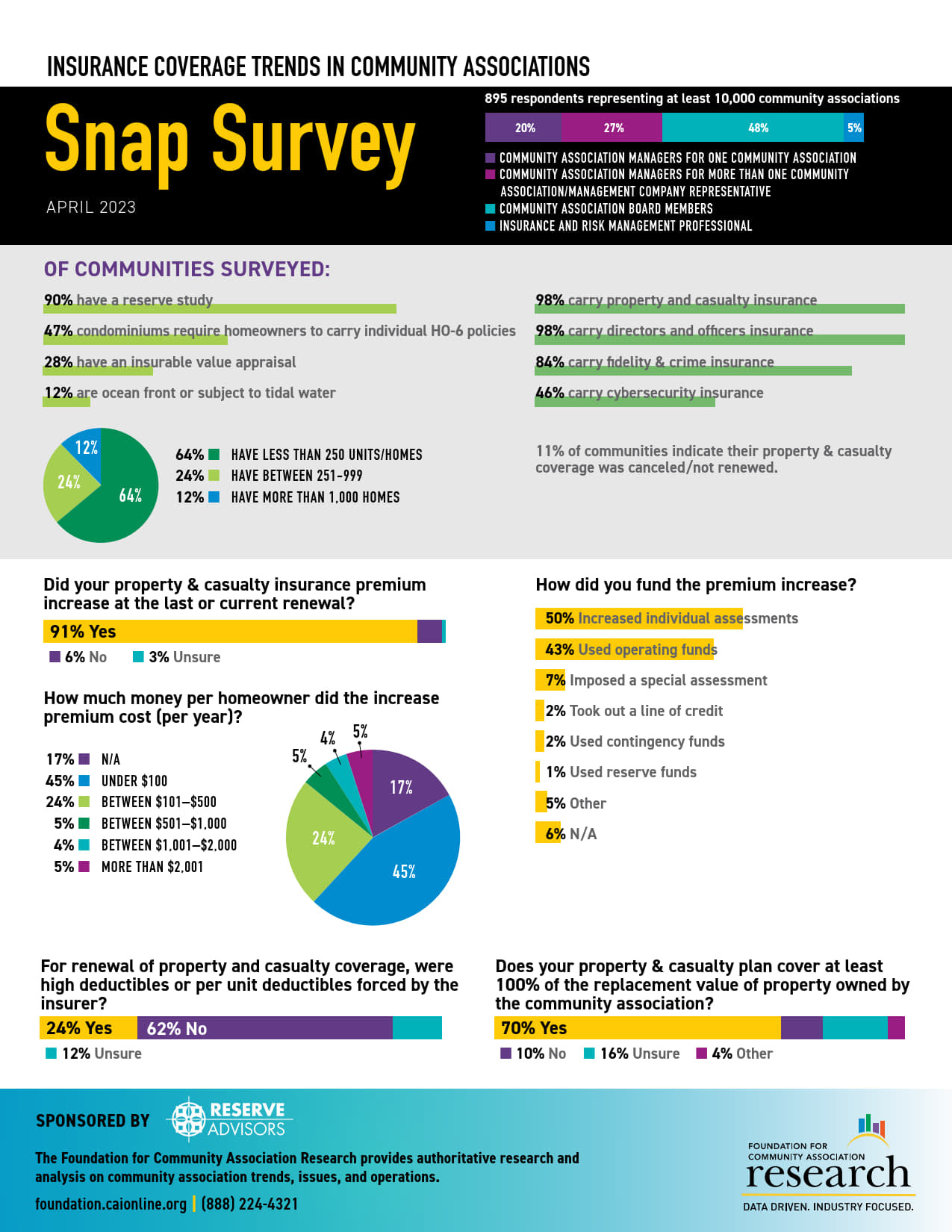

Below is a copy of CAI National’s Snap Survey about the current insurance market that mostly Boards/Managers responded with their experience. From our understanding of what other insurance agencies across the country are dealing with, we feel confident that our exclusive insurance program is in a much better position than most. Our premium increases have remained mostly between 6% – 10% so far this year unless there was an underwriting anomaly or loss issue; that is less than the average according to the survey.

While we can only speak for CISA and can’t give exact numbers for next year, we continue to be hopeful the market will change. In the meantime, the best guess we can advise is to budget between a 15-20% increase to be on the safe side. If an association has had any new losses they should budget more depending on the type of loss and loss ratio; to obtain a better estimate call your CISA Account Executive to help determine what increase and/or deductible change to expect.

Another topic that is sometimes overlooked is budgeting for the insurance deductibles; since most of the industry is increasing deductibles it is important to update and include these in the budget. And while CISA doesn’t have many wind/hail deductibles on our program, most of the Illinois marketplace does and these deductibles should also be budgeted. The wind/hail deductibles are usually a percentage of the building(s) insurable replacement cost and can be cost prohibitive to an association which is why we prefer not to use this form of risk management. But if these large deductibles are not properly budgeted for; it may cause a special assessment.

Hopefully, this information will help Associations’ strategically plan for the rising costs of insurance.

Jennifer Eilert of Condominium Insurance Specialist of America

Our multiple law office locations allows us to meet with you at a convenient location.

admin@csrlawfirm.com Mon – Fri 9:00-5:00

This article is being provided for informational purposes only. This article does not constitute legal advice on the part of Costello Sury & Rooney. or any of its attorneys. No association, board member or any other individual or entity should rely on this article as a basis for any action or actions. If you would like legal advice regarding any of the topics discussed in this article and/or recommended procedures for your association going forward, please contact our office.